Otwórz własny sklep internetowy

Testuj wszystkie funkcje sklepu internetowego przez 14 dni. Za darmo i bez zobowiązań.

Wystartuj z dowolnego miejsca, z pełnym wsparciem

Niezależnie od tego, czy i gdzie dzisiaj sprzedajesz - możesz korzystać z naszych usług.

Sklep internetowy

Wybierz dopracowane w szczegółach i intuicyjne w obsłudze oprogramowanie dla sklepu internetowego.

Sprzedaż wielokanałowa

Prezentuj swoje produkty na kluczowych platformach sprzedażowych. Handluj równolegle w wielu kanałach.

Płatności online

Do dyspozycji masz niezawodne bramki płatnicze, płatności odroczone i systemy płatności ratalnych.

Dostawy i logistyka

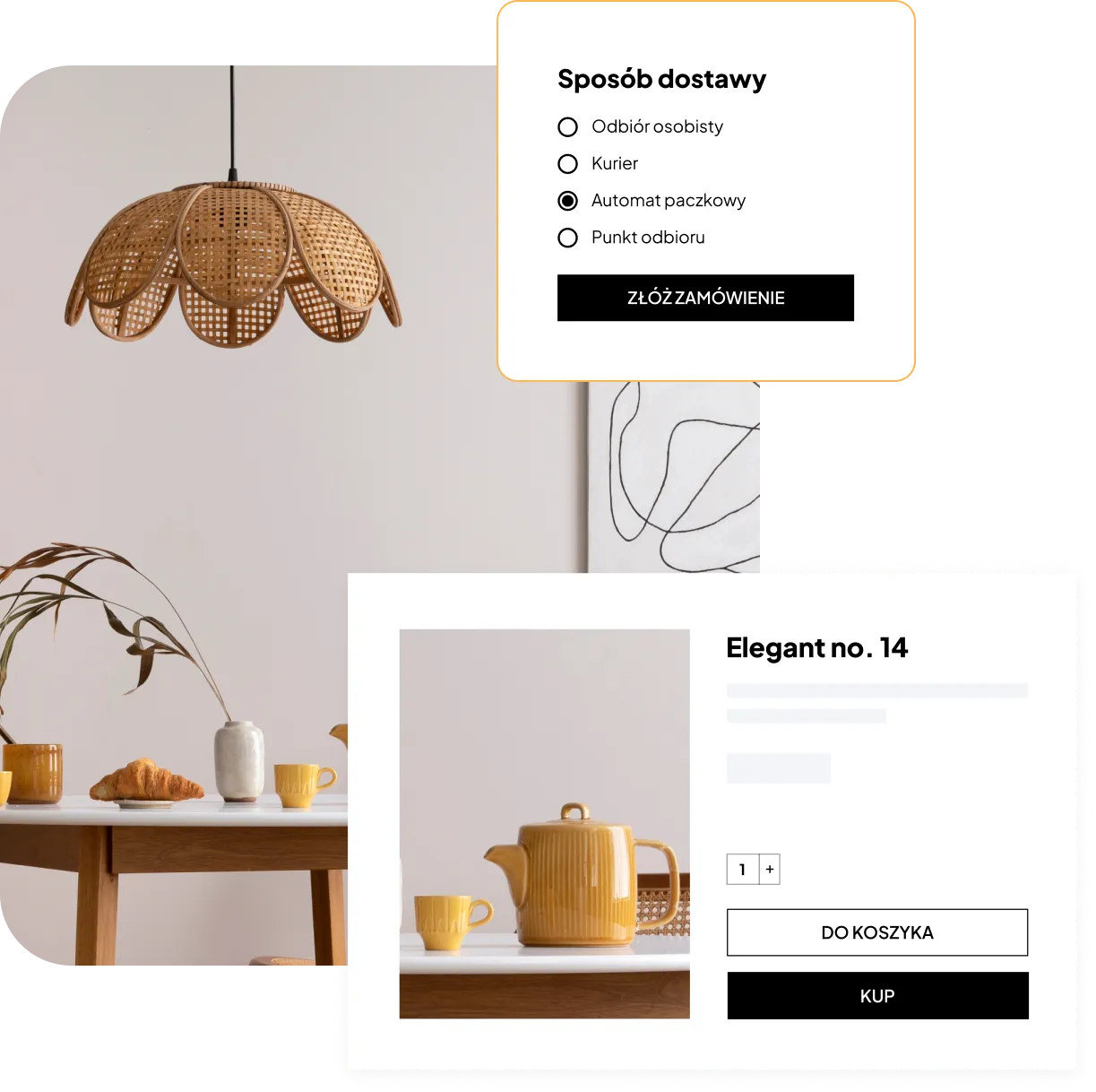

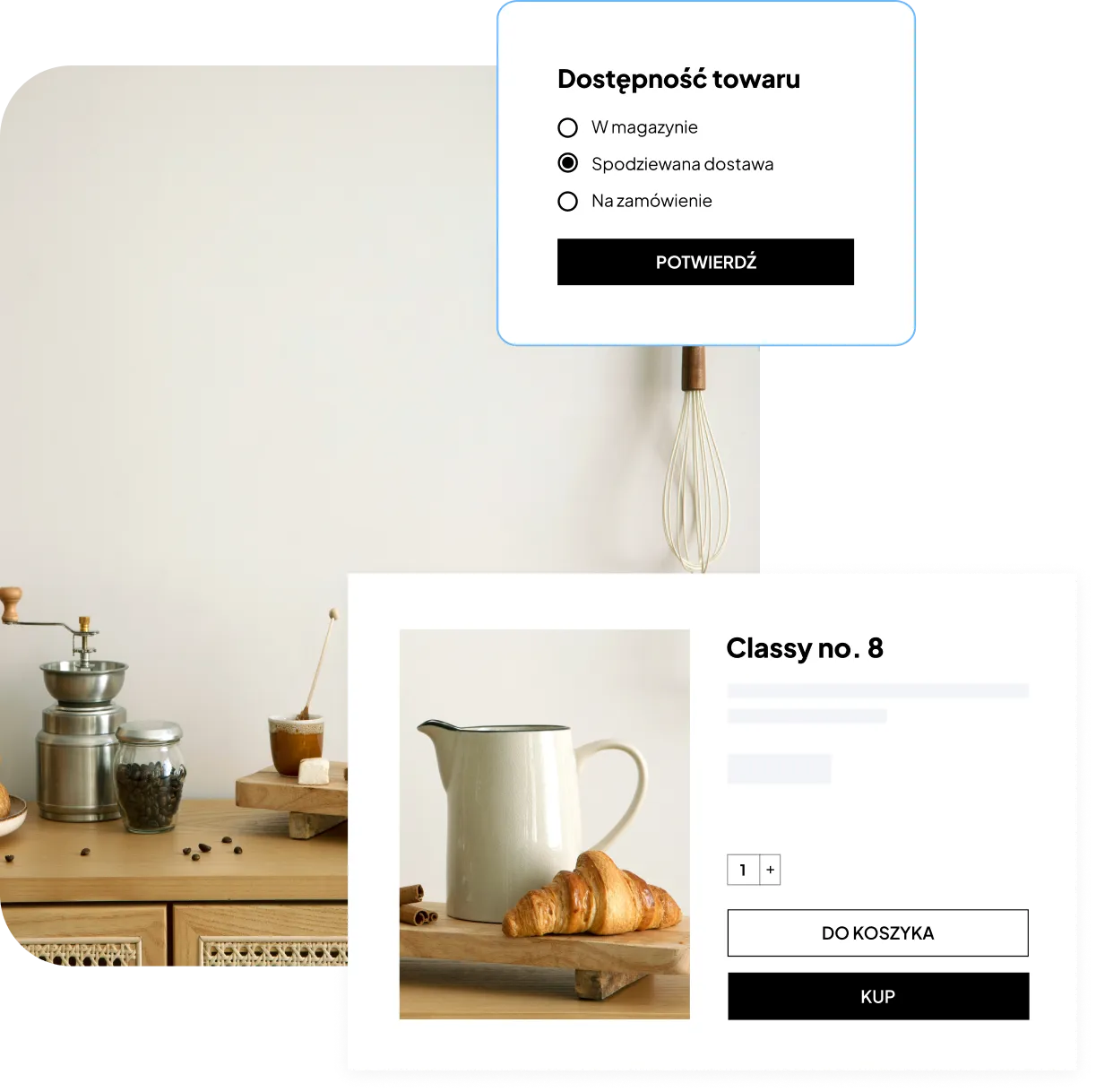

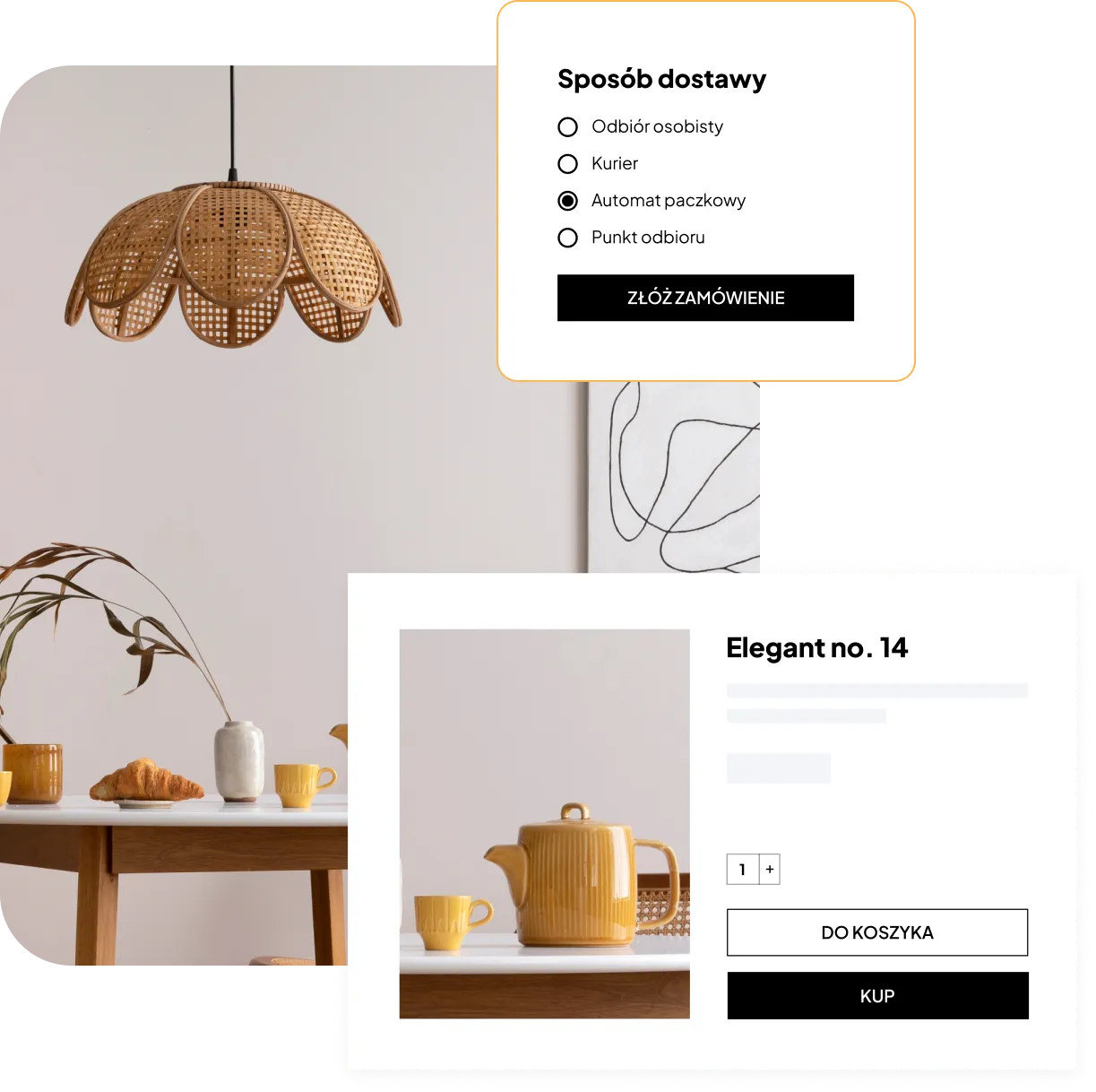

Wybieraj spośród wielu opcji – kurierów, automatów paczkowych, punktów odbioru i przesyłek międzynarodowych.

Kampanie reklamowe

Promuj się w wyszukiwarkach, mediach społecznościowych i dodatkowych kanałach efektywnej sprzedaży.

-p-1080.webp)

Sprzedawaj w sieci. Profesjonalnie

Stań się jednym z tysięcy niezależnych przedsiębiorców, którzy budują z nami swoje sklepy.

Rozpocznij sprzedaż w internecie

Stawiasz pierwsze kroki w biznesie online? Nasza technologia i doświadczeni specjaliści sprawią, że prowadzenie sklepu internetowego to będzie świetna przygoda!

Przenieś do sieci biznes stacjonarny

Szukasz nowych kanałów dotarcia do klientów? Już nie musisz, bo wiemy, czego potrzebujesz i chętnie wesprzemy cię w prowadzeniu sklepu internetowego.

Zmień oprogramowanie na lepsze

Potrzebujesz sprawdzonych i niezawodnych narzędzi, aby dalej rozwijać sprzedaż w swoim sklepie internetowym? Jesteś w dobrym miejscu!

Rozwiń sprzedaż w e-commerce

Nie pozwól, by technologia ograniczała rozwój biznesu. Wybierz szereg rozwiązań połączonych ze sklepem internetowym, w tym skuteczne usługi reklamowe.

Sklep internetowy, o jakim marzysz

Nasze sklepy świetnie wyglądają. I są niezawodne.

Otwórz własny sklep internetowy

14 dni darmowych testów

Gotowe szablony graficzne

Setki dodatków i aplikacji

Bezpłatna pomoc

techniczna

Docieraj do klientów w wielu kanałach jednocześnie

Łączymy kanały dotarcia, by maksymalizować wyniki twoich kampanii sprzedażowych.

Ściśle współpracujemy z m.in. z takimi gigantami jak Allegro, Amazon, eBay, Empik i OLX. Dzięki temu produkty możesz sprzedawać nie tylko w swoim sklepie, ale na wielu platformach jednocześnie.

Twoi klienci spędzają czas w serwisach Facebook, Instagram czy TikTok? To świetnie, bo wiemy, jak wypromować sklep internetowy właśnie w tych miejscach.

Dbamy o każdy szczegół. Także o to, by twój sklep świetnie działał i wyglądał zarówno na komputerach, jak i na urządzeniach mobilnych. Czyli wszędzie tam, gdzie czas spędzają twoi klienci.

Polska to za mało? Z nami twój biznes jest gotowy na efektywne działania międzynarodowe. Dzięki naszym rozwiązaniom zagraniczne platformy handlowe stoją przed tobą otworem.

Zarządzaj szybciej dzięki gotowym integracjom

Dostarczamy gotowe do wdrożenia integracje z systemami, które świetnie sprawdzają się w sklepach internetowych.

Zadbaj o wygodę swoich klientów poprzez udostępnienie im ulubionych metod płatności. Transakcje oraz zwroty są szybkie i bezpieczne.

Pozwól wybierać swoim klientom najdogodniejsze dla nich formy dostawy produktów. My gwarantujemy łatwą integrację z najpopularniejszymi operatorami w kraju i za granicą.

Wybieraj spośród setek hurtowni i poszerzaj asortyment swojego sklepu internetowego. Sprzedawaj wygodnie w modelu dropshipping – hurtownia zadba o wysyłkę towaru.

Postaw na pełną automatyzację procesów, bieżący przepływ informacji o stanach magazynowych i kontrolę faktur.

Poszerzaj funkcjonalności sklepu internetowego dzięki autoryzowanym aplikacjom, dodatkom i wtyczkom dostępnym w naszym Shoper App Store.

Promuj się efektywnie wśród kupujących

Walcz o zasięgi twoich działań promocyjnych i ściągaj do siebie nowych klientów.

Kampanie reklamowe

Buduj rozpoznawalność sklepu internetowego i maksymalizuj sprzedaż dzięki skutecznym działaniom promocyjnym.

Pozycjonowanie sklepów internetowych

Zadbaj z nami o stronę internetową sklepu i jej dokładną optymalizację, by naturalnie budować wysoką pozycję w wyszukiwarce Google.

Najlepsze i darmowe wsparcie specjalistów e-commerce

Przetestuj sklep internetowy Shoper przez 14 dni za darmo

Korzystaj ze wszystkich funkcji oprogramowania za darmo i bez zobowiązań.

.webp)